A New Era of Bitcoin Security and Liquidity: The Lombard Security Consortium

February 17, 2025

7 minutes read

At Lombard, our mission is to unlock the full potential of Bitcoin and drive the growth of the digital economy. Bitcoin is an asset class of its own, yet its use as a productive financial asset on-chain remains largely untapped. By connecting Bitcoin to every chain, DeFi protocol, and yield opportunity, Lombard will realize Bitcoin’s trillion-dollar potential.

Achieving this vision requires more than innovation—it demands robust, decentralized infrastructure designed for long-term security and scalability.

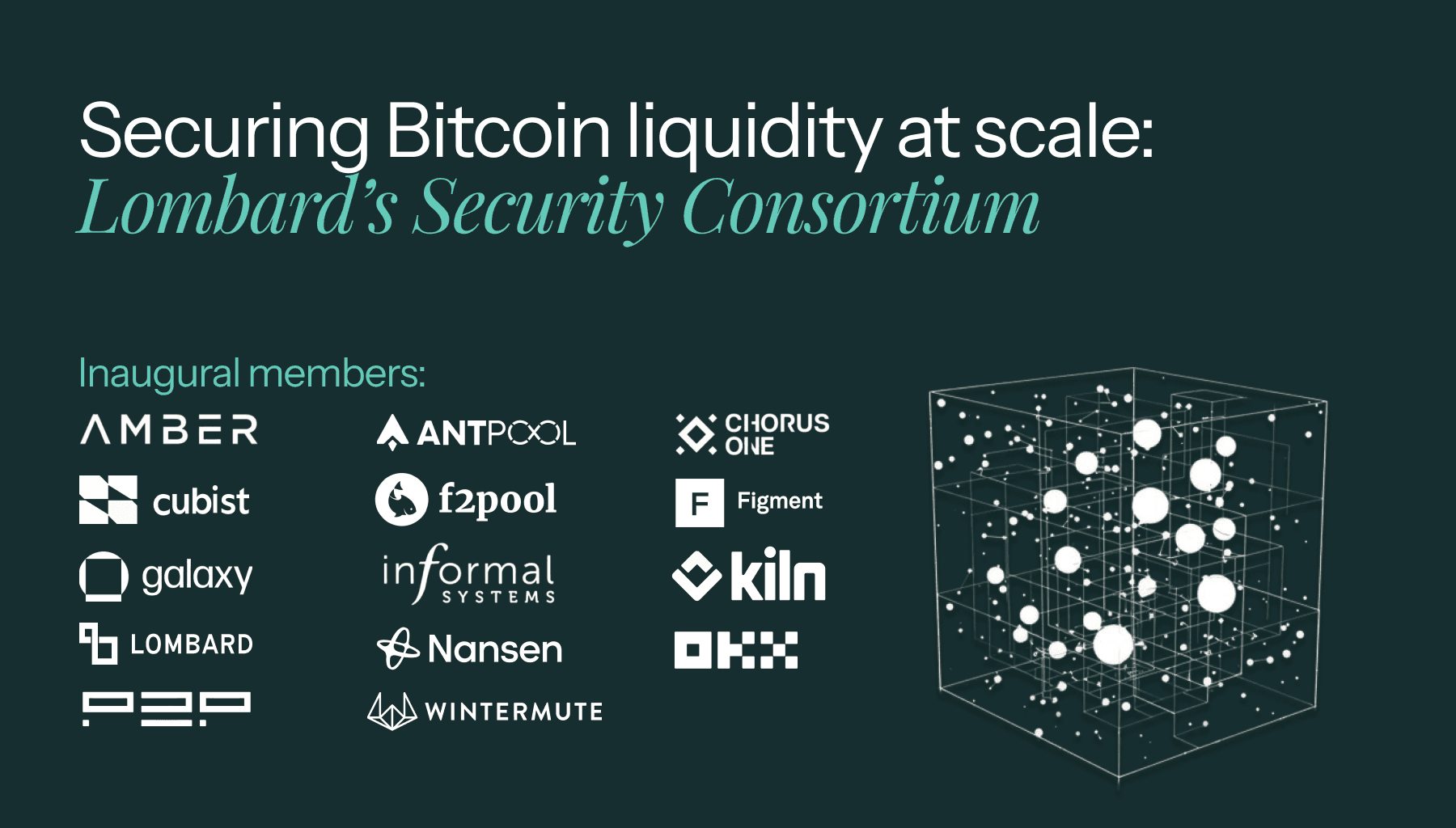

That’s why we’re excited to announce the Lombard Security Consortium, a decentralized consensus mechanism engineered to provide scalable security as Lombard grows to support $100 billion in Bitcoin liquidity. The Security Consortium is composed of leading crypto institutions spanning market makers, mining pools, validators, and technology providers, including OKX, Galaxy, Wintermute, Amber Group and more.

The Lombard Security Consortium: A Decentralized Approach to Security

The Lombard Security Consortium is a network-owned initiative governed and secured by Bitcoin-aligned digital asset institutions—all working together to drive the adoption of Lombard’s current and future on-chain products, including LBTC. Through collective consensus from independent parties with uncorrelated security setups, the Consortium facilitates every transaction on the Lombard protocol, including mints, redemptions, staking and bridging.

This design eliminates single points of failure by requiring the majority of validators to reach consensus on every transaction. This decentralized approach ensures the highest levels of security, while transparency is achieved by recording all activities on the Lombard Ledger, a Byzantine fault-tolerant blockchain, which provides a verifiable and immutable record of operations.

This unification of leading digital asset institutions around the Lombard Protocol establishes LBTC as a shared financial primitive and sets a new standard for security and transparency in Bitcoin finance—a market in desperate need of security best practices.

Meet the Inaugural Members

We are proud to introduce the inaugural members of the Lombard Security Consortium, a collective of 14 leading digital asset institutions committed to securing Bitcoin’s role as a productive asset in the digital economy.

Inaugural Members:

Leading Crypto Institutions

- Galaxy – Galaxy is a digital asset leader bridging financial services, blockchain infrastructure, and Web3 innovation.

- OKX – A global cryptocurrency exchange and Web3 platform.

Leading Liquidity Providers

- Amber Group – A global digital finance leader offering comprehensive wealth management, asset management, liquidity solutions, as well as incubation and investment services.

- Wintermute – A leading algorithmic trading firm focused on building liquid and efficient markets in digital assets.

Leading Mining Pools

- ANTPOOL - ANTPOOL a leading cryptocurrency mining platform, is dedicated to delivering high-quality multi-currency mining services.

- F2Pool – F2Pool is a global mining pool securing Bitcoin and 40+ PoW networks since 2013.

Leading Institutional Validators

- Chorus.one – Chorus One is a leading institutional staking provider for 50+ Proof-of-Stake networks.

- Figment – A leading blockchain infrastructure and staking provider, offering institutional staking and blockchain infrastructure for PoS networks.

- Kiln – Kiln is a leading enterprise platform for institutional digital asset rewards and white-label earning solutions.

- P2P – P2P offers non-custodial staking infrastructure for Web3 wallets, exchanges, and custodians.

Security & Research Partners

- Cubist – A key management infrastructure provider specializing in high-performance, security-critical use cases including protocols, staking, and cross-chain bridging.

- Informal Systems – Providing security audits, protocol design, and formal methods for blockchain applications and infrastructure.

- Nansen – Nansen is the leading onchain analytics platform trusted by the top crypto teams and investors.

"The launch of the Lombard Security Consortium is a crucial step forward in securing Bitcoin’s future as a dynamic financial asset. By bringing together industry leaders, we are establishing LBTC as a shared financial primitive and setting a new benchmark for security and transparency in Bitcoin finance. We’re proud to collaborate with such a distinguished group to unlock Bitcoin’s full potential in the digital economy." Jacob Phillips, Co-Founder of Lombard Finance.

"At Wintermute, our mission is to advance the decentralized world by fostering more transparent, fair, and efficient markets. Efficient markets thrive on liquidity, and LBTC introduces capital inflows into the ecosystem. To fully integrate Bitcoin into the digital economy, a secure, decentralized, and transparent infrastructure is essential. We are excited to join the Lombard Security Consortium to help shape the next phase of Bitcoin finance and champion industry-leading security best practices." Tim Wu, Head of Defi at Wintermute.

"Building secure and scalable digital infrastructure is key to advancing the broader digital economy. Bitcoin’s role as a productive financial asset is still in its early stages, and the Lombard Security Consortium is setting a new standard for its integration across DeFi and institutional markets. Galaxy is proud to contribute to this initiative, supporting Bitcoin’s evolution through security, transparency, and interoperability." Zane Glauber, Head of Blockchain Infrastructure at Galaxy.

"At P2P.org, we always value the security of assets — it’s a core part of our mission. Being part of the Lombard Security Consortium and contributing to the largest LST in Bitcoin staking is truly exciting for us. As strong believers in Bitcoin’s future, we are proud to collaborate with crypto institutions, market makers, mining pools, and validators to support BTC’s growth and drive the adoption of LBTC. This initiative not only strengthens the Bitcoin ecosystem but also opens the door to new and innovative staking opportunities. We are excited to build the future of Bitcoin staking with Lombard and our partners." Alex Esin, CEO of P2P.org

"Amber Group is proud to join the Lombard Security Consortium, furthering our commitment to securing Bitcoin as a foundational asset in the digital economy. By collaborating with leading industry institutions, we’re helping to build a decentralized infrastructure that ensures the highest levels of security, liquidity, and transparency. Together, we’re unlocking Bitcoin’s full potential and driving the next wave of innovation in digital finance.” Luke Li, Co-Founder & Head of Markets at Amber Group.

The Role of the Consortium

The Lombard Security Consortium operates with an emphasis on decentralization, where members operate independently to reach consensus and securely validate every transaction on the protocol. Key responsibilities include:

- Staking & Unstaking: Consortium members facilitate staking transactions to lend economic security to Bitcoin Secured Networks, via the Babylon ecosystem.

- Transaction Validation: Members verify Bitcoin deposits and authorize the minting of new LBTC into circulation. For redemptions, members uphold protocol rules to honour withdrawals within the specified time window.

- Protocol Governance & Upgrades: The Consortium oversees protocol upgrades and ensures security standards are upheld across supported blockchains.

- Cross-Chain Bridging: Members enable the secure and seamless bridging of LBTC across multiple blockchain environments, providing additional security on-top of Chainlink CCIP, a similar approach taken as Circle to secure USDC across chains.

Building the Future of Bitcoin Liquidity

The Lombard Security Consortium marks the beginning of a new era for Bitcoin’s role in the digital economy. By bringing together industry-leading institutions, leveraging cutting-edge security mechanisms, and fostering decentralization, Lombard is building a robust infrastructure that will enable Bitcoin to realize its full potential as a productive financial asset.

As we continue to scale and innovate, the Security Consortium will play a pivotal role in ensuring the security, transparency, and liquidity of Bitcoin across DeFi protocols and blockchain ecosystems. This initiative is not just about protecting Bitcoin’s value—it’s about unlocking the trillion-dollar opportunity that Bitcoin enables to disrupt traditional markets and create new opportunities for all.

Stay tuned for more updates as we work towards a future where Bitcoin is not only the world’s most valuable asset but also the foundation of a thriving decentralized financial ecosystem.